Short takes on happenings in the Indian financial sector. Plus dashes of other interesting stuff thrown in. Enjoy!

Saturday, July 28, 2012

Sunday, July 22, 2012

Water is Wet, Report Finds

Financial Services Professionals Feel Unethical Behavior May Be a Necessary Evil and Have Knowledge of Workplace Misconduct

Alternate Title: Financial Service Professionals Not Exactly The Most Ethical Dudes On The Planet

Wonder who'll do a similar survey/study in India.

Friday, July 20, 2012

Suggested Reading - 1

A Brief History of Money - Or, how we learned to stop worrying and embrace the abstraction

Concise. Well-written. James Surowiecki is one of my favorite 'finance' writers, and this is a good piece by him.

If you're feeling too lazy, you can go through a timeline here.

Fun fact: I was an IEEE member once!

Econo-rap...

Sigh, I don't want to just copy and paste stuff, but how could I let this pass?

Keynes vs. Hayek - The Rap Battle

They should use this stuff to teach in colleges.

Keynes vs. Hayek - The Rap Battle

They should use this stuff to teach in colleges.

Wednesday, July 18, 2012

Got Cherry?

Heh. Got this via Dealbreaker - Warren Buffett, known for his extraordinary love of Cherry Coke, can't pick Cherry Coke out of a line-up!

Here, look!

Here, look!

Monday, July 16, 2012

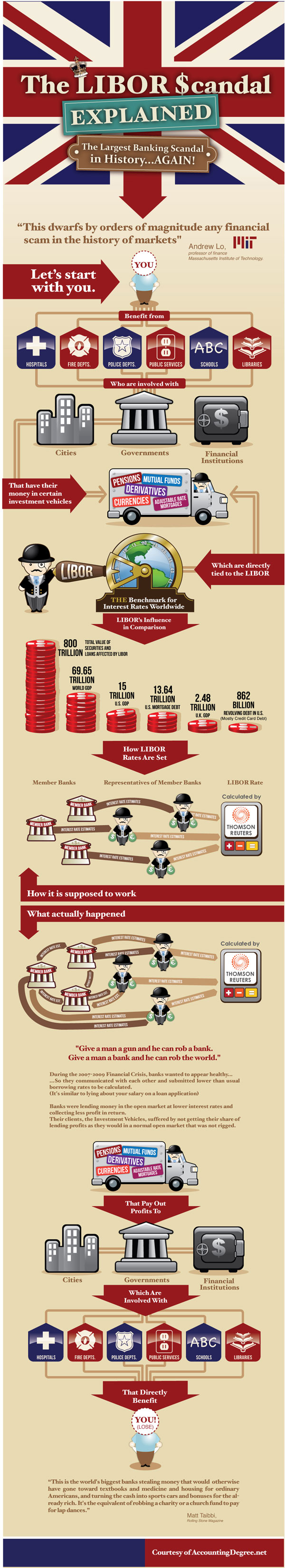

On the continuing LIBOR saga...

Wow, has it really been 9 days since I posted something here last?

Have been busy but that shouldn't excuse the tardiness. I hope not to repeat this again. I haven't been totally off the grid, but have been collecting (assimilating?) info about the LIBOR saga, which is moving into really sticky terrain.

In no particular order,

In case you didn't quite get what LIBOR is from my long-winded explanation, here's a much better primer from Donald MacKenzie. What's in a number? One very important part that I left out earlier is that each input given by a bank is made public soon after the day's rate is published, which means that the manipulation, if any, was done entirely in public.

Here's a link to a MS report on 'LIBOR Risk Sizing' for banks. A lot of jargon. Skip past all the predictions; if someone's put it down on paper somewhere, its a pretty good bet its not going to happen. The interesting part begins from Page 7 onwards, where they start with implications for UK banks, then go on to give details of litigation that the banks find themselves in, and on Page 9, where they give the disclosures that various banks have made in their filings. UBS looks next in the firing line, which is also what the chatter around the market has been.

Some good editorials/blog posts: Lie More, as a Business Model, where the author correctly identifies the role of incentives in this, and in my opinion, most other scams. If your income depends on you lying, chances are that you will lie. Also read this excoriating piece from the Economist: The Rotten Heart of Finance. From The London Banker, which I haven't been following, but must now, comes Lies, Damn Lies and LIBOR.

And from FT's Martin Wolf:

My interpretation of the Libor scandal is the obvious one: banks, as presently constituted and managed, cannot be trusted to perform any publicly important function, against the perceived interests of their staff. Today’s banks represent the incarnation of profit-seeking behaviour taken to its logical limits, in which the only question asked by senior staff is not what is their duty or their responsibility, but what can they get away with.

Ouch.

The Economist, also to be noted, has made 'Banksters' an official term. This will hurt.

The Telegraph says Lock 'em up!

Here's a linkfest not of my making. The Big Picture blog rounds up articles from 2007-08 which were talking about the LIBOR scandal. None of this is new, its just blowing up now...

September 26, 2007: The Financial Times – Gillian Tett: Libor’s value is called into questionOne of these is a growing divergence in the rates that different banks have been quoting to borrow and lend money between themselves. For although the banks used to move in a pack, quoting rates that were almost identical, this pattern broke down a couple of months ago – and by the middle of this month the gap between these quotes had sometimes risen to almost 10 basis points for three month sterling funds. Moreover, this pattern is not confined to the dollar market alone: in the yen, euro and sterling markets a similar dispersion has emerged. However, the second, more pernicious trend is that as banks have hoarded liquidity this summer, some have been refusing to conduct trades at all at the official, “posted” rates, even when these rates have been displayed on Reuters.April 16, 2008: The Wall Street Journal – Bankers Cast Doubt On Key Rate Amid Crisis

The concern: Some banks don’t want to report the high rates they’re paying for short-term loans because they don’t want to tip off the market that they’re desperate for cash. The Libor system depends on banks to tell the truth about their borrowing rates. Fibbing by banks could mean that millions of borrowers around the world are paying artificially low rates on their loans. That’s good for borrowers, but could be very bad for the banks and other financial institutions that lend to them.May 2, 2008: The Wall Street Journal – Libor’s Guardian Bristles At Bid for Alternative Rate

The group that oversees a widely used interest rate fired back Thursday at an effort to introduce an alternative to the rate, known as the London interbank offered rate, or Libor. In recent weeks, the British Bankers’ Association, which calculates Libor, has faced questions about the accuracy of the rates that a 16-bank panel submits to reflect their dollar-denominated borrowing costs. The group said a review of how Libor is calculated “is due to report shortly,” though it declined to offer an exact date. It also noted that any substitute for Libor — which is supposed to reflect the rates at which banks make short-term loans to one another — would have to meet high standards to “win the market’s confidence.” On Wednesday, ICAP PLC, a London broker-dealer with offices in New York, said it plans to launch a new measure of the rates at which banks borrow dollars. ICAP expects to begin publishing the rate, known as the New York Funding Rate, or NYFR, as soon as next week, said Lou Crandall, chief economist at Wrightson ICAP, a New Jersey research firm that is part of the ICAP group. Mr. Crandall said NYFR isn’t intended to replace Libor.September 24, 2008: The Wall Street Journal: Libor’s Accuracy Becomes Issue Again

Questions on Reliability of Interest Rate Rise Amid Central Banks’ Liquidity Push

Earlier this year, Libor appeared to be sending false signals. Banks complained to the BBA that rival banks might not be reporting their true borrowing costs because they didn’t want to admit that others were treating them as if they had troubles. That led to a BBA review and the pledge that the rates banks contribute would be better policed. Every morning, 16 banks submit borrowing rates in a process that produces Libor rates at lunchtime in London.October 20, 2008: The Wall Street Journal – Bank-Lending Boost Could Spur Thaw

On Friday, three big banks led by J.P. Morgan Chase & Co. made multibillion-dollar offers of three-month funds to European counterparts, causing an immediate stir in the shriveled markets for unsecured lending. That raised expectations that lenders would finally open their doors and businesses would be able to borrow again, removing one of the biggest stresses on the global economy.In the story above (October 20, 2008), JP Morgan, a two trillion dollar bank, made $10 to $15 billion of LIBOR loans to other multi-trillion dollar banks and then proudly announced that LIBOR rates had fallen, the market was thawing and the credit crisis was easing. As we wrote in 2008, this was nothing short of rigging the market.Sum it up and all the revelations we are reading about this week were already evident about four years ago. None of should be surprising. As Jean-Claude Juncker told us last year, “when it becomes serious, you have to lie.”

David Merkel of The Aleph Blog delves into the LIBOR rates from 2005-2008 and this is what he comes up with:

My initial diagnosis is this: whether formally or informally, you have two groups of banks submitting rates for LIBOR. One group is trying to pull LIBOR up, the other is trying to pull LIBOR down. Statistically, if I add up their intercept terms from the first table, they both sum to 0.23%, one positive, the other negative. Even if LIBOR were a simple average, which it is not, this is a colossal game of tug of war, with two equal teams.As it is, LIBOR excludes the outliers, and calculates an average off of those that remain. It’s a difficult measure to manipulate. There may have been attempts to manipulate LIBOR, and even two groups of banks trying to pull LIBOR their own way, but successful systemic manipulation of LIBOR is unlikely in my opinion.But if you disagree, here are the two clusters of banks, pursue their collusions:Coalition to pull LIBOR up

- Barclays

- BTMU

- Credit Suisse

- HBOS

- Norinchuckin

- RBS

Coalition to pull LIBOR down

- Citi

- HSBC

- JP Morgan

- Lloyds

- Rabobank

Start with Barclays and JP Morgan, they are the outliers, and if there is collusion, they are the likely leaders.

When all this is settled, it'll only be the lawyers who are left standing. Lawsuits...and more of the same. Apparently, we're moving on to criminal charges as well, which would be novel. Also here and here. My question is, why isn't any Indian firm suing these banks? C'mon, surely, surely someone in India has entered into a LIBOR-backed transaction. Who'll step up?

The regulators knew something shady was up and really didn't bother about it... Here's Reuters on the same. This is the turn that the scandal has taken in the past week, with the focus shifted to the regulators. The NY Fed basically admitted that it knew Barclays used to manipulate LIBOR and did almost nothing about it. This should mean more bad news for the banks. If the regulators find themselves falling into a shit-hole, you can damned well be sure that they won't go in there first, or at least, not before pushing everyone else in before them. And now they'll be under more pressure to come down even more harshly on the banks.

And after reading all this LIBORamayana, if you're still asking who/what LIBORam is, go here and here and also, see this:

Saturday, July 7, 2012

I want me this job...

In connection with the Merger described in Item 2.01 of this Current Report on Form 8-K and pursuant to the terms of the Merger Agreement, effective as of the effective time of the Merger, William D. Johnson, the former Chairman, President and Chief Executive Officer of Progress Energy, was appointed as the President and Chief Executive Officer of Duke Energy.Mr. Johnson, age 58, was Chairman, President and Chief Executive Officer of Progress Energy, from October 2007 through July 2, 2012. … Mr. Johnson previously served as President and Chief Operating Officer of Progress Energy, from January 2005 to October 2007.Mr. Johnson subsequently resigned as the President and Chief Executive Officer of Duke Energy. See disclosure below under the heading “Resignation of Mr. Johnson and Reappointment of Mr. Rogers.”

He was hired, and fired, within three paragraphs. Oh, and within 5 days too.

Don't feel too bad for him though, for lookee what he gets!

For his part, Mr. Johnson has received a lucrative exit package, according to a securities filing. He will receive payments of about $44 million, which includes a $7.4 million severance. He receives a lump-sum payment of $1.5 million so long as he does not disparage Duke and cooperates with the company.

See, even finance can be fun! Read those two links if you want to get into all the nitty-gritties...

Yes, I know I promised I'd write about 'Indian' happenings... And I will, just as soon as I find something juicy enough!

Oh, and be warned, more LIBOR juice to come in during the week!

Tuesday, July 3, 2012

LIBOR Cyborg - IV

I'm sorry, I really didn't want to do one more, but what else is there?

The Chairman resigns, taking moral responsibility for an executive decision. CEO digs his heels in and not-so-subtly threatens the Central Bank. Next morning, like a palace coup, the CEO is gone. His replacement will be chosen by the going-going-gone-but-not-really Chairman. There's news that the COO might be following the CEO. Isn't it simply delightful when a scandal is upon us?

It is becoming obvious that the Board decided to sacrifice the Chairman in order to save the CEO, but things got so far out of hand that he simply couldn't be saved. Its also come to light that the CEO was, in effect, asked to be thrown out by BOE Governor's eyebrows Juicy.

Oh and wait for it, there's a Parliamentary meeting on the issue tomorrow, at which the now-ex CEO is going to testify and where he reportedly plans to put a part of the blame on BOE by saying that he was told by BOE officials that you know, you don't really have to tell them what you think your actual LIBOR rates are. And whatever little incentive he might have had to keep his trap shut must have been totally thrown out of the window by this removal, right? Cannot wait for that to get over now...

The BBC says The City of London is in panic. One man's panic is another man's entertainment you know...

Reads:

LIBOR Cyborg - III

Whoa, whoa, whoa... This is huge.

Barclays CEO Bob Diamond has resigned today with immediate effect. From the press release:

Source: FT Alphaville and here

The search for his replacement would be helmed by Marcus Agius, the Chairman who resigned yesterday. I suppose he'd be staying on now till a new CEO is found.

And here's the letter he sent to Barclays staff yesterday: CEO Letter

Somebody's actually losing his job? That's a new one, no?

Barclays CEO Bob Diamond has resigned today with immediate effect. From the press release:

3 July 2012Barclays PLC and Barclays Bank PLC (Barclays)Board changesBarclays today announces the resignation of Bob Diamond as Chief Executive and a Director of Barclays with immediate effect. Marcus Agius will become full-time Chairman and will lead the search for a new Chief Executive. Marcus will chair the Barclays Executive Committee pending the appointment of a new Chief Executive and he will be supported in discharging these responsibilities by Sir Michael Rake, Deputy Chairman.The search for a new Chief Executive will commence immediately and will consider both internal and external candidates. The businesses will continue to be managed by the existing leadership teams.Bob Diamond said “I joined Barclays 16 years ago because I saw an opportunity to build a world class investment banking business. Since then, I have had the privilege of working with some of the most talented, client-focused and diligent people that I have ever come across. We built world class businesses together and added our own distinctive chapter to the long and proud history of Barclays. My motivation has always been to do what I believed to be in the best interests of Barclays. No decision over that period was as hard as the one that I make now to stand down as Chief Executive. The external pressure placed on Barclays has reached a level that risks damaging the franchise – I cannot let that happen.I am deeply disappointed that the impression created by the events announced last week about what Barclays and its people stand for could not be further from the truth. I know that each and every one of the people at Barclays works hard every day to serve our customers and clients. That is how we support economic growth and the communities in which we live and work. I look forward to fulfilling my obligation to contribute to the Treasury Committee’s enquiries related to the settlements that Barclays announced last week without my leadership in question.I leave behind an extraordinarily talented management team that I know is well placed to help the business emerge from this difficult period as one of the leaders in the global banking industry.”Commenting, Marcus Agius said, “Bob Diamond has made an enormous contribution to Barclays over the last 16 years of distinguished service to the Group, building Barclays Investment Bank into one of the leading global investment banks in the world. As Chief Executive he has led the bank superbly. I look forward to working closely with the Chief Executives of our businesses and the other members of the executive Committee in leading Barclays world class businesses in serving our customers and clients and delivering value for our shareholders.”

Source: FT Alphaville and here

The search for his replacement would be helmed by Marcus Agius, the Chairman who resigned yesterday. I suppose he'd be staying on now till a new CEO is found.

And here's the letter he sent to Barclays staff yesterday: CEO Letter

Somebody's actually losing his job? That's a new one, no?

Monday, July 2, 2012

LIBOR Cyborg - II

And we have the first casualty.

Barclays Chairman Marcus Agius confirmed today that he would resign, taking responsibility for the LIBOR fiasco. They're also launching an independent probe of business practices.

Let's see how far it goes, yes?

Barclays Chairman Marcus Agius confirmed today that he would resign, taking responsibility for the LIBOR fiasco. They're also launching an independent probe of business practices.

Let's see how far it goes, yes?

Sunday, July 1, 2012

LIBOR Cyborg - I

So, as I'd said earlier this week, I spent some time educating myself about LIBOR beyond the perfunctory nod given to it in our MBA classes; not that I blame them, it is a rather mundane, even arcane thing to look at. Anachronistic even. LIBOR just is, why would anyone want to go into that?

But now that this shit's blowing in our faces that LIBOR might not be what we think it to be (and the more I read, the more I wonder how we decided to go along with it in the first place), I think I should put together my thoughts on who, what and why the LIBOR is, and some thoughts on the scandal. What I am trying to do is put together a small guide to educate myself in rather simple words. So bear with me, yes?

The LIBOR

LIBOR - London InterBank Offered Rate - is the rate at which a select panel of banks thinks that they can borrow from another bank for a period of time.

If this confuses you, we'll come back to it later. Let's go through the process of how LIBOR is determined and by the end of it, you'll understand what the line above means, alright?

First things first, the LIBOR is not just one rate. The LIBOR is produced for 10 currencies for 15 maturities, giving a total of 150 LIBORs running around at any point of time.

This is how it would look like - everyday.

s/n - spot/next; o/n - overnight

Right, so we need 150 rates a day. How do we get them?

Every day, between 11.00 and 11.10 am (London Time), one person each from a panel of 6-18 banks inputs each of these rates into a Thomson Reuters terminal, where it is collated, after removing the top 25% highest rates and bottom 25% lowest rates. The middle 50% rates are then averaged and voila, you get the LIBOR rates.

So what does the person input? He puts in answers to the following question:

"At what rates could you borrow funds, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 a.m.?"

i.e. If someone wants to lend you unsecured money for a certain amount of time in a certain currency, how much interest would they charge you?

The 'unsecured' part is important. Remember, the more credit-worthy the market thinks you are, the lower the rate that you are able to borrow at. Therefore, the implication is, if you can borrow at a lower rate, the stronger you are.

To give an example:

Every morning, a person from Barclays (from their cash management team, I suppose) sits at his Thomson Reuters terminal and keys in the answer to the following questions:

1. At what rates could you borrow GBP overnight, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 a.m.?

2. At what rates could you borrow GBP for one week, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 a.m.?

....16. At what rates could you borrow USD overnight, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 a.m.?17. At what rates could you borrow USD for one week, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 a.m.?.......

Note: All banks are not on all the panels. So, Barclays might be on the panel for 7 currencies, JP Morgan for 8, Lloyd's for 6 and so on. They give the inputs for the currencies they are on the panel for.

Not "at what rates are you able to borrow funds", but "at what rate could you borrow funds".

Not for a specified amount, but for "reasonable size".

All subjective, nothing objective. It is rather surprising, isn't it? That such a fundamental unit is calculated in such a rather whimsical way?

Why is LIBOR important?

From the CFTC order on the Barclays fine -

The BBA represents that LIBOR is intended to be a barometer to measure strain in money markets, that it often is a gauge of the market's expectation of future central banle interest rates, and that approximately $350 trillion of notional swaps and $10 trillion of loans are indexed to LIBOR. LIBOR also is the basis for settlement of interest rate futures and options contracts on many of the world' s major futures and options exchanges, including the three-month and onemonth Eurodollar contracts on the Chicago Mercantile Exchange ("CME"). Measured by the notional value of open interest, the CME Eurodollar contract is the most liquid and largest notional futures contract traded on the CME and in the world. The total traded volume of the CME Eurodollar contract had a notional value of over $437 trillion in 2009 and $564 trillion in 2011. It settles based on the three-month U.S. Dollar LIBOR published on the Monday before the last trading day of the contract month. Moreover, LIBOR is fundamentally critical to financial markets and has an enormously widespread impact on global markets and consumers. LIBOR also affects businesses seeking credit, consumers obtaining mortgages or personal loans, and market participants transacting in numerous other financial contracts in the U.S. and abroad that are based on the benchmark interest rates.

Central Banks around the world look at LIBOR for setting policy rates. Monetary policy is often set around achieving certain LIBOR rates or at managing spreads between LIBOR and other rates (two central banks I know of that are/were using LIBOR are ECB and Swiss Central Bank). These rates influence policy decisions.

Yeah, so they're pretty important.

So, What's the problem here?

There are two accusations that I've been able to work out till now.

1. During the GFC (we've all settled on this acronym, right?), regulators allege that some of the banks quoted artificially low rates for LIBOR, in order to give the impression that they were in better financial health than they actually were. Remember, the lower your rate, the stronger you're supposed to be. While banks internally might know that the other banks were bullshitting (they were, after all, the people who lent to each other in the first place, although I assume there would be some kind of Chinese Wall in place), outside of the banks, regulators, money market funds and other market participants might see them in a different light and think that the situation is better than it actually is.

2. The obvious one, that manipulated rates submitted (and accepted) might lead to lower or higher final LIBOR rates and lead to profits for the trading desks of the investment banks as per their outstanding trades.

The accusation on Barclays is not that it manipulated LIBOR, but attempted to do so i.e. it gave falsified rates during its daily submissions. And not only did it do so for its own benefit, but also accepted requests from other bank's trading/investment desks to do the same. Of course, you couldn't manipulate LIBOR alone even if you wanted to, unless there is collusion between the bankers. The probe's still ongoing, Barclays is simply the first bank who settled (and with a 30% discount for co-operating, yay!), so there's a lot more stuff to come out. We'll keep watching. Citi, UBS, Lloyds, ICAP, RBS and Deutsche are being investigated, but I expect them to settle sooner rater than later.

The Evidence

This is perhaps some of the juiciest stuff I've ever read (in financial terms, obviously). A sampling follows:

*****

*****

*****

From here:

Regulators say they found dozens of communications from 2005 to 2009 in which derivatives traders pressed another group of Barclays employees to try to influence Libor. The British Bankers’ Association, which oversees the standards for calculating Libor, does not allow banks to use interest rates linked to derivatives to determine their Libor submissions.

From here:

“A member of senior management” instructed Barclays’ Libor staff to lower their submissions to make them match other banks and dispel concern about the lender’s health.

The breaches included "included a significant number of employees and occurred over a number of years".

At least 14 derivatives traders, including senior traders, made requests to rate submitters at the bank. From January 2005 through May 2009, at least 173 requests for U.S. dollar Libor submissions were made to Barclays’ submitters. That includes 11 requests based on talks with traders at other banks, the FSA said. There were at least 58 requests for Euribor submissions from September 2005 through May 2009, and at least 26 for yen Libor submissions from August 2006 through June 2009.

“The derivatives traders discussed the requests openly at their desks. At least one derivatives trader at Barclays would shout across the euro swaps desk to confirm that other traders had no conflicting preference prior to making a request to the submitters.”

“The senior U.S. dollar submitter emailed his supervisor, ‘following on from my conversation with you I will reluctantly, gradually and artificially get my libors in line with the rest of the contributors as requested. I disagree with this approach as you are well aware. I will be contributing rates which are nowhere near the clearing rates for unsecured cash and therefore will not be posting honest prices.’’

Fun. Read the two reports at your leisure. It really is fun.

The Result

From here:

While it might be hard for one bank among many to influence Libor, regulators felt Barclays was sometimes able to do so. In the findings for the Barclays settlement, the Justice Department said, “the manipulation of the submissions affected the fixed rates on some occasions.”

Wow, that plus the evidence pretty explicit. So, who's going to jail? No one, that's who, as of now. So they found the bank guilty, and let them go with a simple slap of the wrist. Barclays shareholders might not agree with me that $453 million in fines ($ 200 mn to CFTC, $160 mn to U.S. Dept. of Justice and $93 mn to Britain's FSA) is a small amount, but I think it is. And no criminal prosecutions till now? Well, its still a developing matter so we'll see where it goes. Especially the civil suits which are sure to be forthcoming since LIBOR basically affects everything. There's a reason Barclays and RBS's stock tanked.

In defense of the settlement

Dealbreaker puts it pretty well and I quote it extensively here:

Sometimes Barclays convinced other banks to go along with its plans, but clearly sometimes it was shooting against other banks. One reason not to get over-excited about the Libor scandals is that there seems to have been, roughly speaking, a two-sided market: some banks wanted Libor too low, some wanted it too high, so maybe it ended up just about right. Maybe. With notable exceptions for the depths of the financial crisis, when everyone wanted to look like they could borrow cheaply (or at all), at which point Libor manipulation served as back-door monetary easing? I guess? They should be rewarded, not fined? Meh.

Besides the two-sidedness of the fraud partially cancelling out, there’s perhaps another reason that the CFTC and FSA settled. What the heck is Libor anyway? Look at those criteria that the CFTC half-endorsed: the submitter was supposed to consider things like central bank decisions and “prior LIBOR submissions by Barclays and other panel banks” in making its submission, rather than just looking for objective measures of where Barclays could borrow money that day. That makes sense, of course, since Barclays wasn’t in the habit of borrowing in all of the currencies and tenors of Libor every day and so had to do a certain amount of guessing – but I submit to you there were a whole lot of days where expectations about future FOMC decisions (or prior JPMorgan borrowing rates) were not uppermost in the minds of those considering lending money to Barclays. But once you’re on board with the fact that Barclays’ submitted was guessing in the best of circumstances, it’s harder to argue that biased guessing is “manipulating a commodity” as opposed to just picking a different number out of thin air. That might be a stumbling block for regulators taking this case to court, making them willing to settle. And it’s easy to see why Barclays wanted to settle – getting all those emails quoted in a settlement is embarrassing, but nothing like as bad as getting them read in court.

While I don't agree with the first point - If everyone was lying, get everyone to jail - but we know that's not going to happen; the second one makes more sense. Taking Barclays or any other bank to court would not guarantee convictions, so the regulators took a call of slapping them on the wrist. Doesn't make me feel any better about it, though.

So what's being done now?

The investigation is ongoing. Let's see who all come to settle now.

Here's a graphic I found about possible changes to LIBOR setting. Couldn't find the Credit Suisse report in its entirety. If anyone does, let me know. None of them seem particularly effective in the face of human greed and/or fear though.

(Click for a better look)

Is LIBOR really relevant?

Look at a bank's LIBOR submissions. Look at its floating paper rate in the market. During bad times, they certainly won't match. So what's the point of using it? Its the stickiness of standards. Once a thing, any thing has been accepted as a standard, it would take years, even decades to replace or to phase out. For example, if you decided to replace the LIBOR, what about the 10-year, 20-year, even 50-year papers denominated in LIBOR? If you change the definition of LIBOR, what would stop your counter-party from going to court and calling it a 'force majeure' event? It'd all be very brilliant for the lawyers, who seem to make out like crazy when shit blows up. Someone should be seriously looking at the role of lawyers in the GFC, you know for writing such impenetrable stuff that no one can make head or tails out of it, and allowing people to get away with illegal or at least quasi-legal stuff.

One more important point is that some of these figures are outright guesses; if I had to pick one, it would be the NZD-11m rate. Such transactions just don't exist. Its difficult enough to get Euro or USD unssecured funding for anything more than three months, for other currencies there's just no market. So why bother having them in the first place? This also negates the possibility of replacing the 'could you fund' part of the LIBOR question with 'do you fund' because then you won't get any rate at all, because these transactions don't exist!

There is some good stuff (with charts) on Sober Look blog here and here about how LIBOR is becoming less relevant, especially in Europe because banks simply aren't picking up from each other as much as they used to. First, because they know this is not a reliable source of funding and that it will dry up at the first instance of any trouble; Second, because they've all shifted to repo or secured transactions and third, because they deal with the ECB directly rather than with each other.

His/her suggestions for alternatives include the Overnight Index Swaps (OIS) or the actual Swaps/Repo rates. But the problem here is the same because swaps for longer than 3 months hardly exist.

Another rate could be at what rate the banks CP is placed in the money markets.

The Conclusion

All this LIBOR business is, at its heart, a damning indiction of the utter and total moral failure at most (all) major banks, who justifiably have concluded that they can do anything they want and get away with it because there is nothing and no one to stop them. Plus they get to make shit-tons of money while they do it. Would you not do it if you were in their place? Don't answer, because you're not in their place.

So that's that, in a nutshell, I suppose. This should be about it for now. Might do one more on what changes are being thought of to improve/fix the LIBOR setting mechanism. Hit me up if you want to talk.

Look at a bank's LIBOR submissions. Look at its floating paper rate in the market. During bad times, they certainly won't match. So what's the point of using it? Its the stickiness of standards. Once a thing, any thing has been accepted as a standard, it would take years, even decades to replace or to phase out. For example, if you decided to replace the LIBOR, what about the 10-year, 20-year, even 50-year papers denominated in LIBOR? If you change the definition of LIBOR, what would stop your counter-party from going to court and calling it a 'force majeure' event? It'd all be very brilliant for the lawyers, who seem to make out like crazy when shit blows up. Someone should be seriously looking at the role of lawyers in the GFC, you know for writing such impenetrable stuff that no one can make head or tails out of it, and allowing people to get away with illegal or at least quasi-legal stuff.

One more important point is that some of these figures are outright guesses; if I had to pick one, it would be the NZD-11m rate. Such transactions just don't exist. Its difficult enough to get Euro or USD unssecured funding for anything more than three months, for other currencies there's just no market. So why bother having them in the first place? This also negates the possibility of replacing the 'could you fund' part of the LIBOR question with 'do you fund' because then you won't get any rate at all, because these transactions don't exist!

There is some good stuff (with charts) on Sober Look blog here and here about how LIBOR is becoming less relevant, especially in Europe because banks simply aren't picking up from each other as much as they used to. First, because they know this is not a reliable source of funding and that it will dry up at the first instance of any trouble; Second, because they've all shifted to repo or secured transactions and third, because they deal with the ECB directly rather than with each other.

His/her suggestions for alternatives include the Overnight Index Swaps (OIS) or the actual Swaps/Repo rates. But the problem here is the same because swaps for longer than 3 months hardly exist.

Another rate could be at what rate the banks CP is placed in the money markets.

The Conclusion

All this LIBOR business is, at its heart, a damning indiction of the utter and total moral failure at most (all) major banks, who justifiably have concluded that they can do anything they want and get away with it because there is nothing and no one to stop them. Plus they get to make shit-tons of money while they do it. Would you not do it if you were in their place? Don't answer, because you're not in their place.

So that's that, in a nutshell, I suppose. This should be about it for now. Might do one more on what changes are being thought of to improve/fix the LIBOR setting mechanism. Hit me up if you want to talk.

Links/Further Reading:

1. Libor Basics

P.S.:

(Don't ask me about the title. I had to make something rhyme with LIBOR. Again, don't ask.)

Songs listened to while writing this: Entire OST of Cocktail, Ishaqzaade, Gangs of Wasseypur and Agneepath

At the end, a splitting headache.

Subscribe to:

Posts (Atom)